EquiLend SFTR

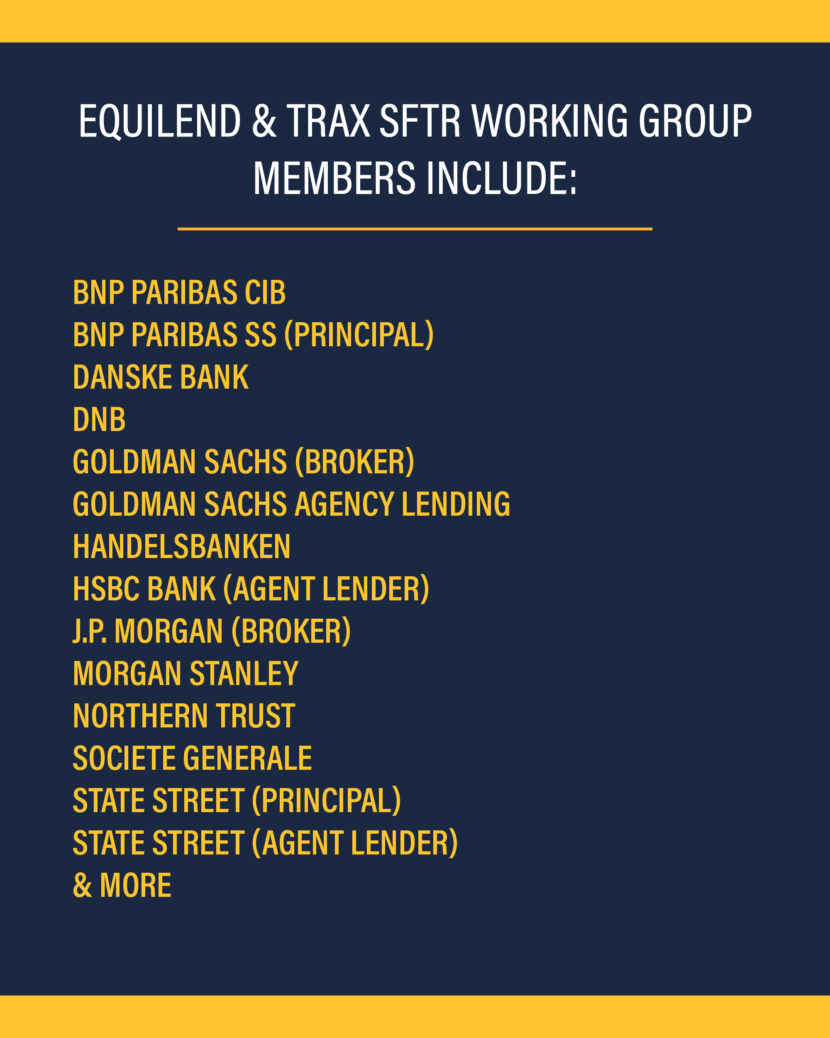

EquiLend and TRAX, the post-trade services engine of MarketAxess, are collaborating on a full front-to-back Securities Financing Transactions Regulation (SFTR) solution to support the industry in meeting their reporting obligations.

EquiLend’s expertise in the securities finance industry combined with TRAX’s regulatory reporting and repo trade confirmation heritage result in a comprehensive service covering all SFTR eligible asset classes.

SFTR Brochure

Our Solution

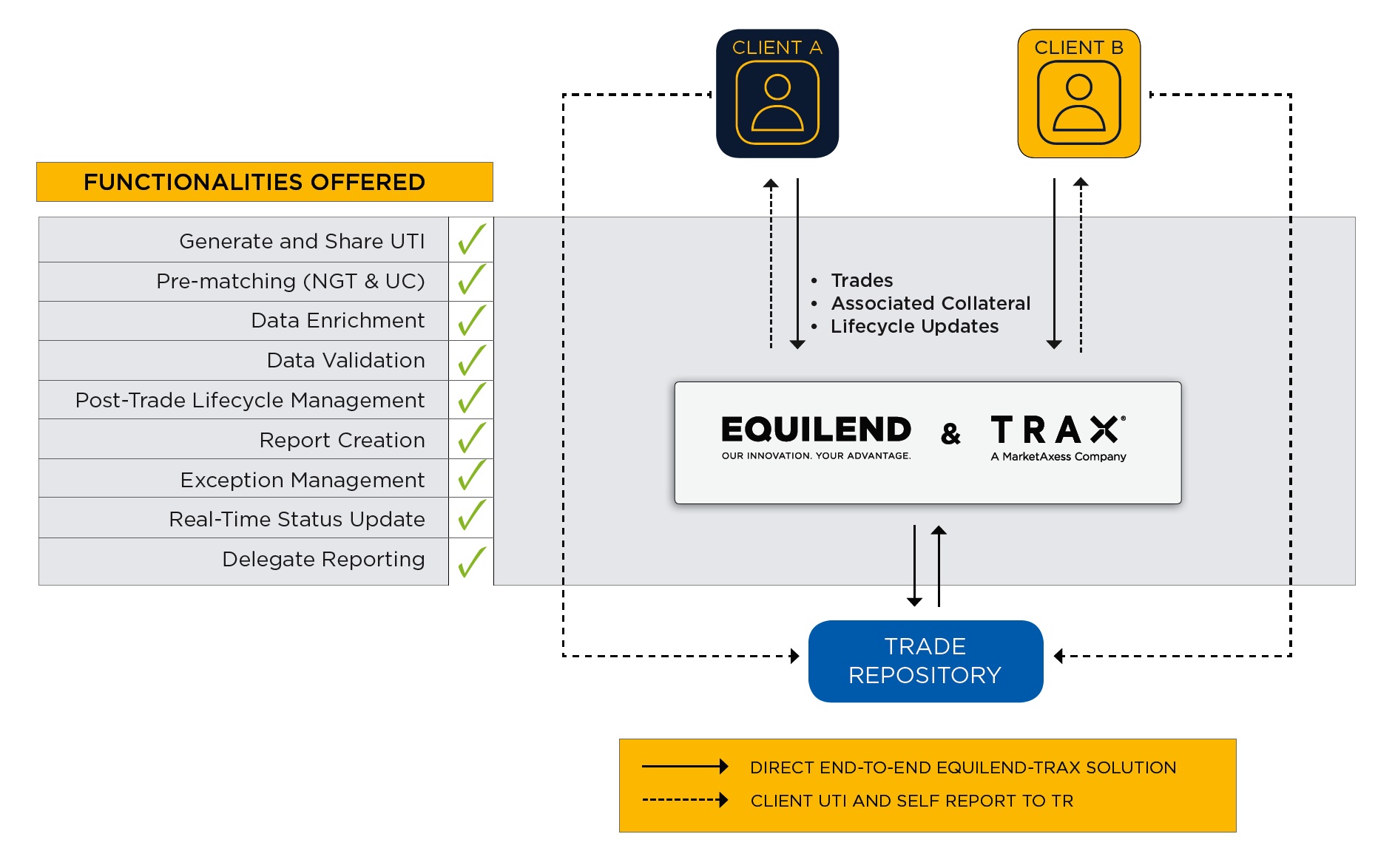

Clients need to report to a chosen trade repository by T+1 both sides of a trade, any associated collateral, plus modifications throughout the lifecycle using a common UTI. They must also manage any exceptions in the reporting flow. Additionally, clients must deal with any reconciliation discrepancies flagged by the trade repository. The EquiLend and TRAX solution enables firms to meet regulatory requirements by using regulated trading, post-trade and reporting platforms to do the following:

As leading providers of trading, confirmation and reporting solutions, EquiLend and TRAX are ideally placed to offer solutions around Unique Transaction Identifier (UTI) generation, timestamps and lifecycle events to help firms meet their reporting obligation. EquiLend and TRAX offer a joint solution that allows firms subject to SFTR to obtain a pre-repository match to help ensure accurate reporting and efficient exception management processing.

The fully interoperable solution enables the onward routing of trades to the TRAX Insight engine, which (i) enriches the reports submitted by a client with reference data and (ii) sends the enriched transaction reports to certain trade repositories. The TRAX Insight engine captures and centralises reporting flows, enabling firms to manage exceptions through a single interface and to rely on TRAX’s rules engine to filter and enrich trades. Clients will also be able to benefit from delegated reporting.

Want to Try It Out?

SFTR Brochure

Benefits

Key Benefits of the EquiLend & Trax SFTR Solution

- Expertise in securities finance and regulatory reporting space with access to largest Securities Lending and Repo community

- ESMA-compliant UTI and Execution Timestamp at Point of Trade via NGT and point of matching via Post Trade

- A complete reporting solution including enrichment, eligibility, break management either via Direct or Delegated Reporting

- Message validation and counterparty field comparison pre-repository ingestion

- A centralised view of MiFID and SFTR reporting

- A customisable client dashboard, which includes MI reports and benchmarking

- UTI Portal for industry wide sharing of UTI information

- Insulation from future Regulatory/Repository change cost and development need

- Aggregated reporting price benefit (subject to TR pricing structure)

- Adherence to a common industry solution realizing matching efficiencies and contribution to a vendor aligned collective voice.

Key Benefits of NGT for SFTR

- ESMA-compliant UTI and execution timestamps auto-generated and shared at point of trade, the earliest stage for SFTR reporting

- Loan allocations shared at point of trade, providing UTI and execution timestamps on underlying principal funds and beneficial owners

- 100+ trading client base, offering maximum access to the securities lending and repo community

- A fully automated front-to-back SFTR reporting solution: trades booked on NGT can be subsequently auto-enriched via SFTR Insight with relevant data fields and reported within minutes to the trade repository

- Reconciliations on trades show an average break rate of less than 1% across the lifecycle for transactions executed on NGT versus a 35% break rate for transactions executed off platform

News

Clients of MarketAxess and EquiLend begin SFTR testing (Global Custodian) – June 30, 2019

UnaVista adds 25 technology vendors to SFTR partner programme (Global Custodian) – June 20, 2019

DTCC Expands SFTR Partnerships (Markets Media) – June 10, 2019

Firms Eye SFTR Testing (Markets Media) February 4, 2019

A Day in the Life (Securities Lending Times) How the joint EquiLend/Trax solution can streamline SFTR reporting – October 2018

Is Time Running Out? (Securities Lending Times) Why there needs to be a focus on how your vendors support you – October 2018

SFTR Activity Ramps Up (Markets Media) August 10, 2018

REGIS-TR to Collaborate With EquiLend and Trax on SFTR Reporting Solutions – August 2, 2018

DTCC Collaborates with EquiLend & Trax to Advance Securities Financing Transaction Reporting Processes – June 5, 2018

EquiLend & Trax on SFTR (Securities Lending Times) – May 15, 2018

EquiLend and Trax to Launch Interoperable Front-to-Back SFTR Offering – September 20, 2017