ABOUT SFTR

WHAT IS SFTR?

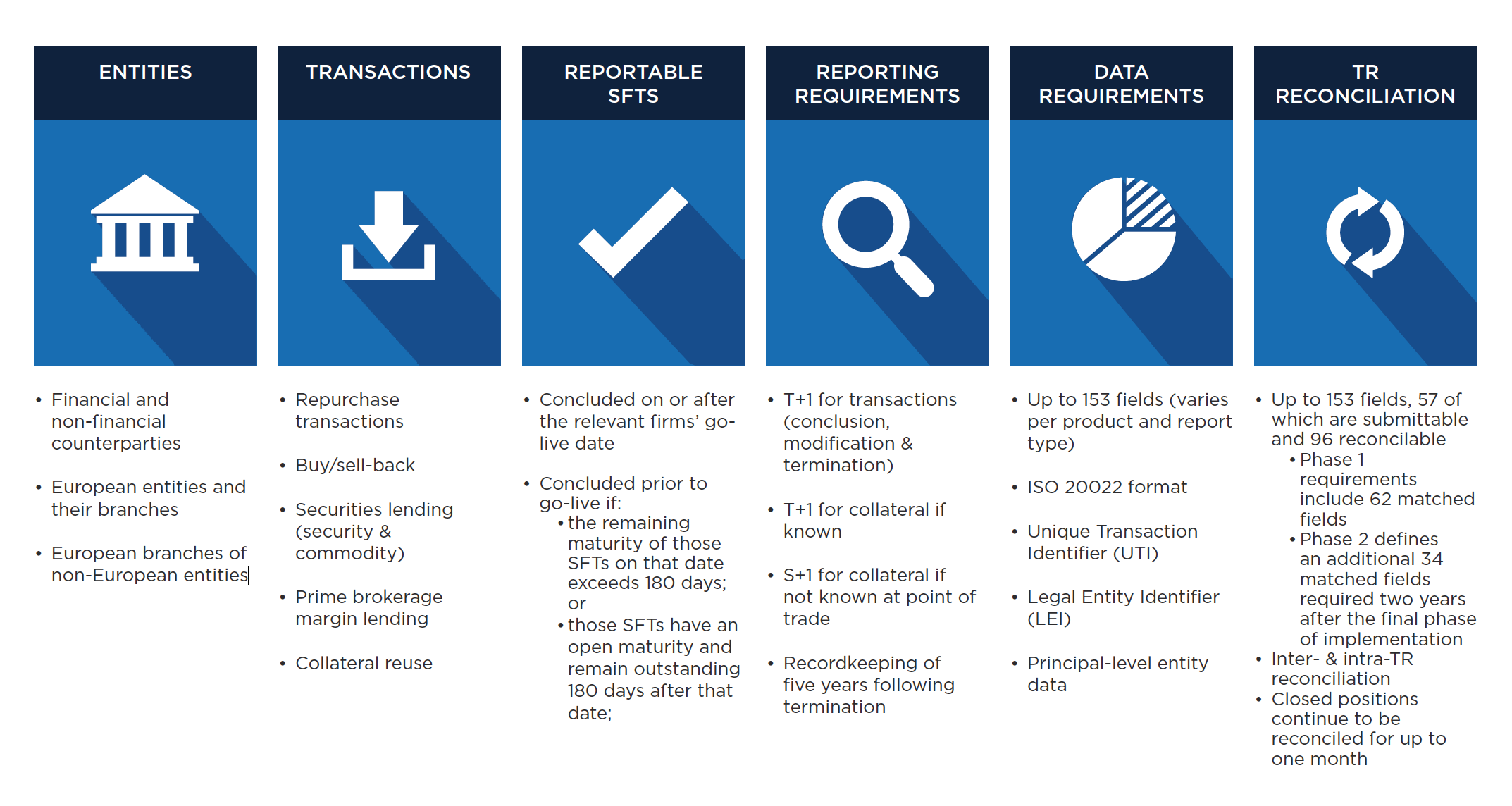

The Securities Finance Transaction Regulation (SFTR) aims to reduce risks by improving transparency in securities financing markets and forms part of the EU’s response to the policy proposals issued by the Financial Stability Board (FSB) in August 2013. It will require counterparties to report details on trades and collateral (including reuse) to a registered trade repository (TR). Managers of UCITS and AIFs are also required to disclose the details of the use they make of SFTs and total return swaps.

The European Securities and Markets Authority (ESMA) issued its final report on the technical standards for SFTR on March 31, 2017, and the European Commission adopted the RTS & ITS on December 13th 2018, leading to a projected live date of Q2 2020. The report details a total of 153 reportable fields covering securities lending, repo, buy/sell-back and margin lending.

WHAT CHALLENGES WILL MARKET PARTICIPANTS FACE WITH SFTR?

Although the European Commission has adopted the RTS & ITS, the date of entry into force for the RTS remains a subject of debate. Nevertheless, what is certain is that the main challenge for market participants will revolve around the content and timing of the reporting requirements for trades and collateral. The reporting requirement is dual-sided and requires the provision of a unique transaction identifier (UTI) for each trade and a legal entity identifier (LEI) for the counterparts in the trade.

A mandatory reporting format has been proposed, which would require the inclusion of a comprehensive series of details throughout the lifecycle of the trade. Market participants will be confronted by the need to track, manage and report a large volume of data, some of which may be captured by upstream or downstream systems, creating a potentially costly requirement to upgrade current systems or build out to external sources.

HOW IS EQUILEND IMPLEMENTING ITS SFTR SOLUTION?

We are working in partnership with Trax and in concert with industry bodies, clients, tri-party agents and TRs to provide an automated, consolidated, scalable solution that removes the necessity for manually intensive intervention from clients and provides transparency throughout the process.

CHALLENGES & CONSIDERATIONS FOR MARKET PARTICIPANTS

For the majority, counterparties are currently recognised by internal codes, and LEIs are not stored in front-end systems. Lenders are challenged with disclosure of their underlying principals (beneficial owners) and the associated timing of that disclosure. The Agency Lending Disclosure (ALD) process as it stands will not facilitate timely reporting. A subsequent challenge for the borrowers is housing the data received from lenders.

Experiences under EMIR highlight the importance of a robust mechanism for generation and sharing of UTIs to support trade matching and reconciliation from initiation through to termination.

All new transactions will be required to have an execution timestamp. These can be generated at point of trade via NGT (EquiLend’s multilateral trading facility). Any off-platform trades require additional attention to ensure agreement within the alloted one-hour tolerance window.

Trades with known collateral are reportable on a T+1 basis. Where collateral is not known at point of trade, it is reportable on S+1. Agency structures with pooled clients collateralised with pooled collateral will need to be appropriately allocated and fully disclosed for onward reporting.

Unlike MiFID, all lifecycle events that impact any of the reportable fields need to be reported through to termination.

Market research, prepared by The Field Effect in its white paper “SFTR: Navigating the Challenge,” has indicated firms may have difficulty sourcing up to 40% of the required reportable data. Governing agreements and versions is one of the many challenges. For some, these legal agreements are centrally stored, but for many this is not the case.

For many, fragmented systems hold various elements of the required data set for reporting. Clients may be faced with the need to upgrade their current infrastructures to support reporting obligations.

Clients will need the ability to identify and capture all in-scope reportable transactions, recognising if they are reportable under SFTR (or MiFID).

Reporting requirements are phased in according to the type of firm. Investment firms and credit institutions go live on day one. Non-financial counterparts (NFCs) go live nine months later. Although NFCs are not required to report for the first nine months, they will still be required to provide beneficiary information and LEIs to their counterparts. UTIs will still need to be generated but are still reportable by just the in-scope party.

News

A Day in the Life (Securities Lending Times) How the joint EquiLend/Trax solution can streamline SFTR reporting - October 2018

Is Time Running Out? (Securities Lending Times) Why there needs to be a focus on how your vendors support you - October 2018

SFTR Activity Ramps Up (Markets Media) August 10, 2018

REGIS-TR to Collaborate With EquiLend and Trax on SFTR Reporting Solutions - August 2, 2018

DTCC Collaborates with EquiLend & Trax to Advance Securities Financing Transaction Reporting Processes - June 5, 2018

EquiLend & Trax on SFTR (Securities Lending Times) - May 15, 2018

EquiLend and Trax to Launch Interoperable Front-to-Back SFTR Offering - September 20, 2017