EQUILEND SFTR

The volume and complexity of data required to comply with SFTR will prove challenging in an environment where many companies already face significant technology budget constraints.

Market participants have options on how to meet their SFTR reporting requirements, including compiling and processing the information on their own from disparate internal systems or outsourcing the effort to a vendor. Yet both will require significant investment and process changes that will be both difficult to implement and costly for market participants.

EquiLend offers the industry’s simplest solution. Our unique position in the market—with existing links to market participants to our industry-leading trading, market data and post-trade services—means we already capture much of the information required by SFTR. That enables us to create the unique transaction identifier (UTI) immediately either at the point of trade or during the post-trade comparison process.

Furthermore, the ESMA consultation paper on draft RTS and ITS, ESMA/2016/1409, confirms that timestamps remain a required field, but a level of tolerance can be applied. The proposal is that several minutes can be applied to a timestamp field, such as execution timestamp. EquiLend provides a timestamp for all activity that clients undertake across the platform.

As a result of EquiLend’s technological capabilities, industry expertise and unique position in the securities finance market, we are able to offer a scalable, cost-effective, light-touch solution—the simplest solution in the market to meet the demands of SFTR.

WHAT IS SFTR?

The Securities Finance Transaction Regulation (SFTR) aims to reduce risks by improving transparency in securities financing markets and forms part of the EU’s response to the policy proposals issued by the Financial Stability Board (FSB) in August 2013. It seeks to impose a series of conditions and rules and will require counterparties to report details on trades and collateral (including reuse) to a registered trade repository (TR). Managers of UCITS and AIFs also will be required to disclose the details of the use they make of SFTs and total return swaps.

WHAT CHALLENGES WILL SECURITIES FINANCE MARKET PARTICIPANTS FACE WITH SFTR?

While the final text has not been concluded, and some relaxation of requirements has been proposed in the Level 2 text, the main challenge for market participants revolves around the content and timing of the reporting requirements for trades and collateral. The reporting requirement is dual-sided and requires the provision of a unique transaction identifier (UTI) for each trade and a legal entity identifier (LEI) for their counterparts in the trade.

A mandatory reporting format has been suggested, which would require the inclusion of a comprehensive series of details throughout the lifecycle of the trade. Market participants will be confronted by the need to track, manage and report a large volume of data, some of which may be captured by upstream or downstream systems, creating a potentially costly requirement to upgrade current systems or build out to external sources.

WHAT IS EQUILEND DOING TO PREPARE FOR SFTR? HOW WILL THE SOLUTION HELP CLIENTS MEET THEIR SFTR REQUIREMENTS?

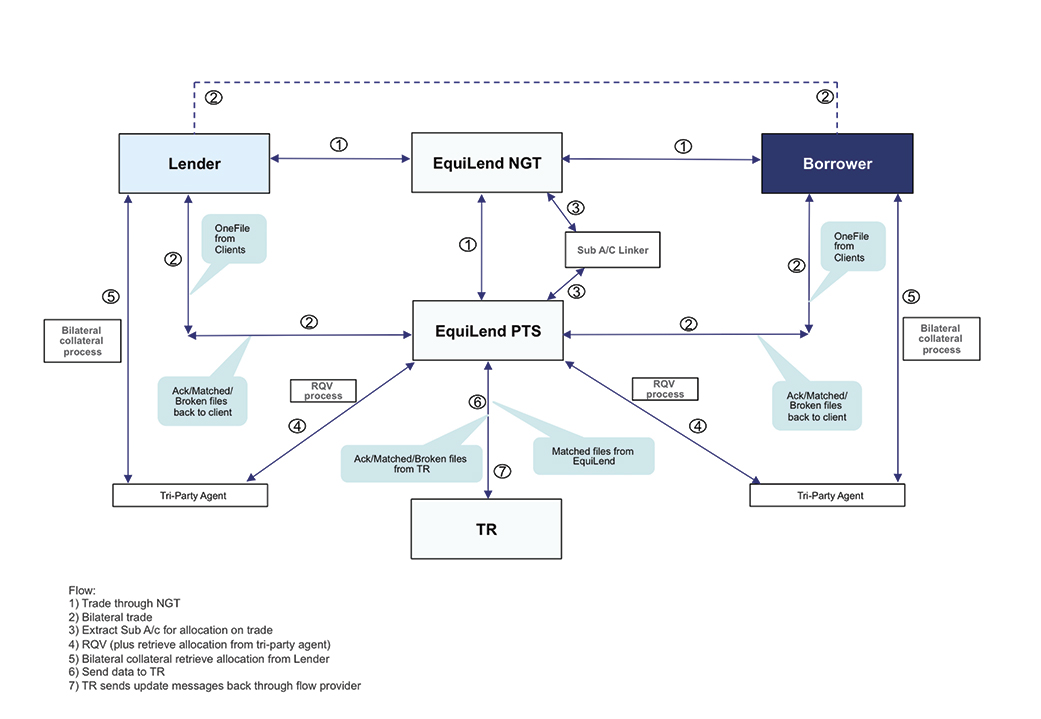

We are working with industry bodies, clients, tri-party agents and TRs to provide an automated, consolidated, scalable solution that removes the necessity for manually intensive intervention from clients and provides transparency throughout the process. As a front-to-back service provider, EquiLend is in a unique position as the best-placed provider in the securities finance industry to capture and create a UTI either at point of trade or during the post-trade comparison process, providing the simplest solution to a complex problem.