Next Generation Trading (NGT)

Next Generation Trading (NGT) is a multi-asset class trading platform for the securities finance marketplace. Accessed through NGT’s intuitive, Web-based user interface or via full automation using our proprietary messaging protocol, NGT offers access to global securities finance trading to firms of all sizes. With tens of thousands of trades conducted on the platform around the globe each day, NGT offers unparalleled liquidity in the securities finance market. NGT’s strategic features increase trade-level transparency, improve workflow automation and generate efficiencies market wide.

Key Benefits

Key Stats

- 110+ firms using NGT globally each day

- NGT users based in 30+ locations around the globe

- Assets domiciled in 50+ markets traded on NGT

- $135bn notional on average traded on NGT each day as of March 2022

- $180 notional: highest notional traded in a single day on NGT on March 22, 2022

NGT Features

-

NGT Chains

Borrowers have the ability to set up a pre-defined order of lenders that they want to transact with, and allow NGT to route borrow requests sequentially, eliminating the need for the borrowers to send in multiple lists

-

Auto Response

For screen lenders, the NGT user interface may be configured to have trades be automatically accepted, or rejected based on user-supplied parameters

-

Integration with ECS for CCP Trades

NGT is connected to EquiLend Clearing Services to facilitate CCP trades via various Central Counterparties

-

Robust STP Capabilities

NGT offers a full set of messaging protocols to allow clients to connect to the NGT engine for straight-through processing capabilities

Monthly Trading Volumes

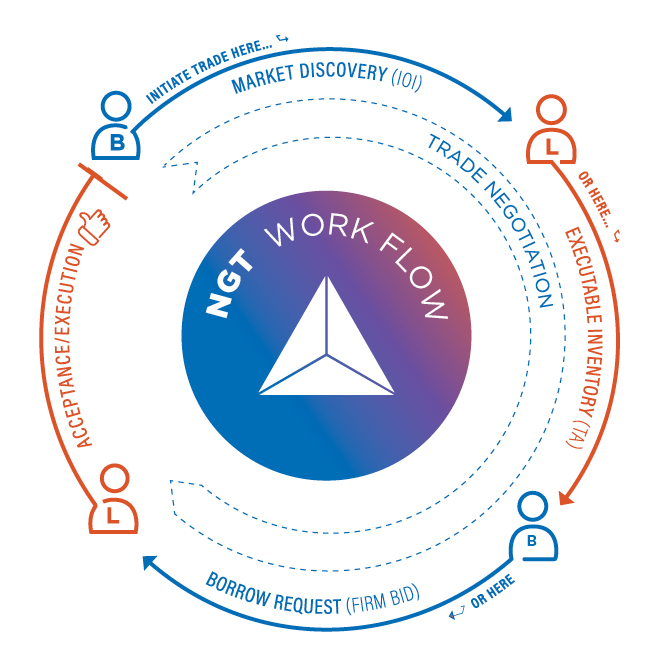

Multiple entry points into the NGT eco-system, catered to your borrowing and lending needs:

-

Indications of Interest - Market Discovery

Borrowers can reach out to multiple lenders to communicate interests for securities. NGT’s Indication of Interest (IOI) functionality uses a proprietary Natural Language Processing (NLP) algorithm to efficiently process emails, standardizing it into a system-readable format for lending counterparts

-

Targeted Availability - Unprecedented Transparency and Liquidity

NGT’s Targeted Availability workflow has made a previously opaque and inefficient market much more transparent as lenders have made strides to actively publish executable inventory, allowing borrowers to have access to the unprecedented liquidity pool Targeted Availability increases the correlation and relevance between Offers and Bids. With the borrowers responding to the Targeted Availability, execution rates has increased dramatically, resulting in a win-win scenario where lenders benefit from higher utilization rates of their assets, and borrowers filling their needs more efficiently

-

Firm Bids – Low Touch General Collateral (GC) Trading

Borrowers can also choose to initiate firm borrow requests to their lending counterparts via NGT for their daily GC borrowing needs. NGT’s messaging capabilities allows for counterparties to communicate seamlessly with one another for a fully automated borrow and lending workflow, system to system

-

Linking It All Together

The various NGT features allow clients the flexibility to pick and choose the different workflows that cater to their needs. For example, clients can use the IOI and Targeted Availability features to negotiate the warm and hard-to-borrow names, while using the Firm Bid feature to handle their GC transactions with their counterparts

Introducing Premium Pulse

Ease of Integration

NGT offers various ways for clients to connect into the eco-system. An intuitive web-based interface allows for traders to transact over the platform, providing a best-in-class user experience while going about their day-to-day trading activities. This includes a real time Order Book, Trade Blotter and a robust series of filters and screen downloads.

For clients who prefer Straight-Through Processing (STP), EquiLend offers a full set of messaging protocols to connect straight into the NGT engine. Borrow requests, Trade offers, execution and trade bookings can all be fully integrated into our clients’ proprietary systems, combining the power of NGT and our clients’ systems for a seamless front-office workflow solution.

NGT is designed and built for full interoperability between the different modes of integration, meaning clients can be fully agnostic to how their counterparties use NGT.

Best Securities Finance Trading Platform Globally

Global Investor/ISF Awards 2012-2020