EquiLend Exposure

Increased regulatory reform, combined with the requirement for financial institutions to manage collateral in a more efficient and cost-effective manner has meant that accurate exposure management and transparency of collateral usage is imperative.

EquiLend Exposure provides a centralized way to highlight intra-day exposure risk, identify discrepancies in collateral requirements between counterparties and facilitate STP connectivity to tri-party agents while enhancing control and governance to ensure that collateral transactions are executed exactly how clients would expect.

Featured

Collateral trading and exposure management have become important issues to financial institutions concerned with efficiency and balance sheet costs. By creating flexible and dynamic processes that take advantage of new trading markets for collateral, EquiLend continues its mission of solving these kinds of complex industry challenges as a trusted technology partner.

Features

-

Automatic connectivity to all tri-party agents, providing straight-through processing (STP) directly from the exposure screens

-

Calculate actual and forecasted exposure numbers split by counterpart and collateral type

-

Absorb counterparts’ equivalent data and provide real-time reconciliation

-

Direct real-time linkage into Unified Comparison facilitating instant view of discrepancies

-

Ability to prioritize collateral requirements, for example, independent calculation and agreement of pre-pay activity

-

Real-time receipt of collateral allocations from tri-party agents

-

On screen visibility to intraday settlement activity to ensure accurate, up to date collateral requirement calculations

-

All up-to-date data absorbed and displayed on configurable, easy-to-view screen

Benefits

Enables greater STP on connecting collateral movements, reducing settlement latency to support loan release and returns processing

Increased profit:

– Accurate funding requirements with real-time view of settlement positions

-Reduces RWA costs by eliminating under or over collateralization of clients

-Reduce operational costs associated with manually reconciling discrepancies and submitting RQV numbers

-Reduce settlement costs associated with failing trades or buy-ins

Enables CSDR and SFTR solution

Exact risk management with all clients; knowing precisely the value of collateral to be provided to each client

RQV – Auto RQV Calculation and Connectivity With Tri-Party

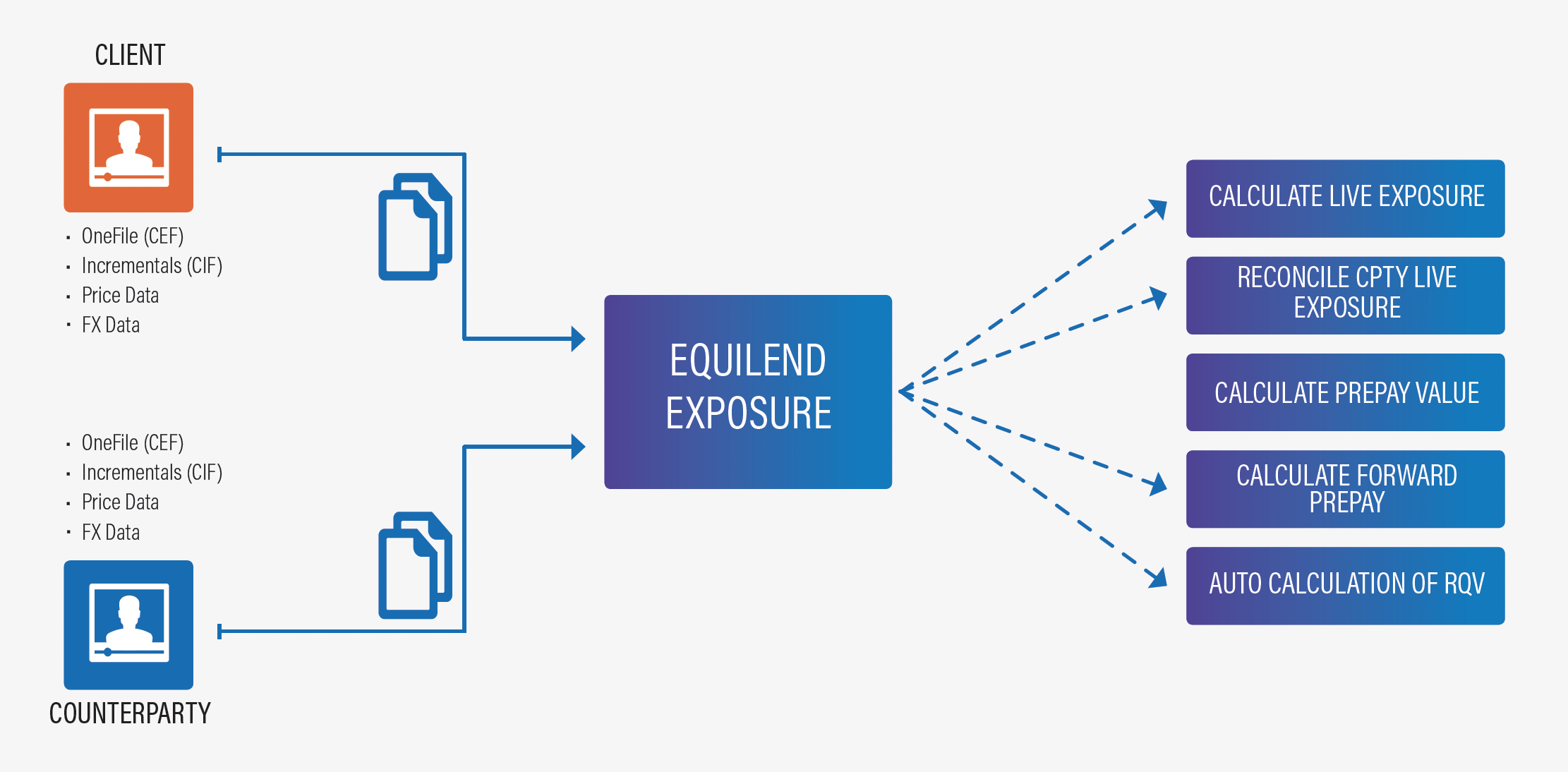

- Using client’s data (CEF, CIF, Price and FX), the EquiLend Exposure system will segregate & calculate today’s prepay and RQV numbers

- System can also calculate the future prepays

- Clients can reconcile the RQV numbers with counterparty RQV numbers (calculated using counterparty’s OneFile)

- User can view the breakdown of prepay & RQV numbers based on the escrow accounts created at each tri-party agent

- User can send today’s prepay number, and once confirmed by tri-party, can send the RQV number to the tri-party agents

- Users can edit the RQV if there are any discrepancies

- Processes the collateral allocation sent by the tri-party agent

- Users can view the breakdown of collateral allocation by the tri-party agent

- EquiLend is connected to global platforms BNY Mellon, Euroclear and JP Morgan tri-party agents. Clearstream will be connected later in 2020.

All data will be leveraged from your OneFile submission

WHO WE ARE

EquiLend is a global financial technology firm offering trading, post-trade, market data, regulatory and clearing services for the securities finance, collateral and swaps industries. EquiLend has offices in New York, Toronto, London, Dublin, Hong Kong and Tokyo.